Taxation Of Investment Income Within A Corporation Manulife Investment Management

How Much Tds Is Deducted On Bank Company And Nro Fixed Deposits Nri Banking And Saving Tips Savings And Investment Investment Tips Investing

Quick Overview Of Czech Real Estate Rsm Cz

Personal Income Tax Interest Income Tax Treatment

Flowchart Final Income Tax Download Scientific Diagram

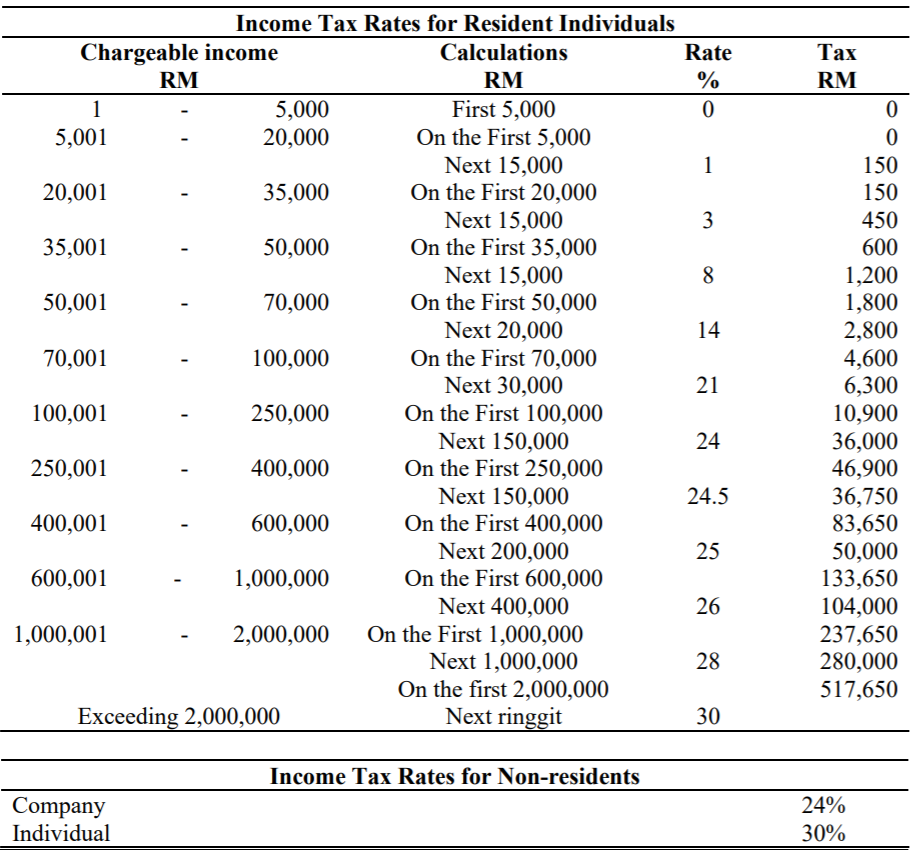

The Following Allowances And Tax Rates Are To Be Used Chegg Com

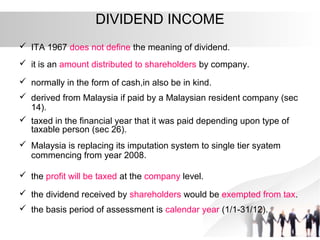

Taxation Principles Dividend Interest Rental Royalty And Other So

In The Matter Of Interest Crowe Malaysia Plt

Is It Mandatory To Declare Foreign Bank Accounts And Assets In Income Tax Return By Nri Nri Saving And Inv Income Tax Savings And Investment Investment Tips

Individual Income Tax In Malaysia For Expatriates

Corporate Income Tax In Malaysia Acclime Malaysia

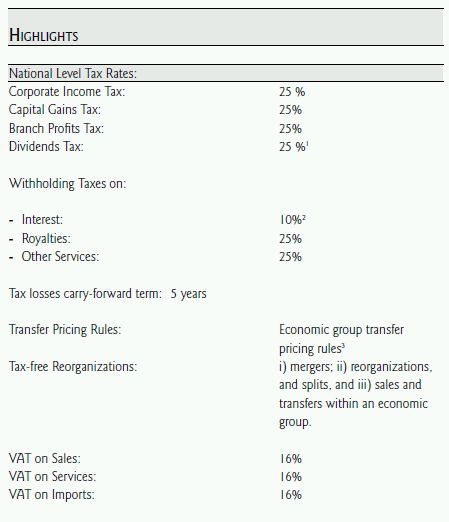

Managing Corporate Taxation In Latin American Countries Dominican Republic Corporate Tax Dominican Republic

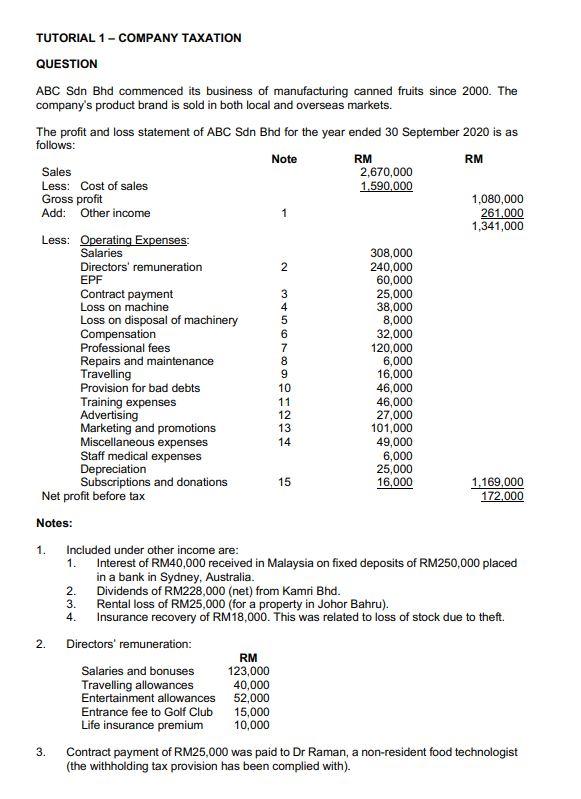

Tutorial 1 Company Taxation Question Abc Sdn Bhd Chegg Com

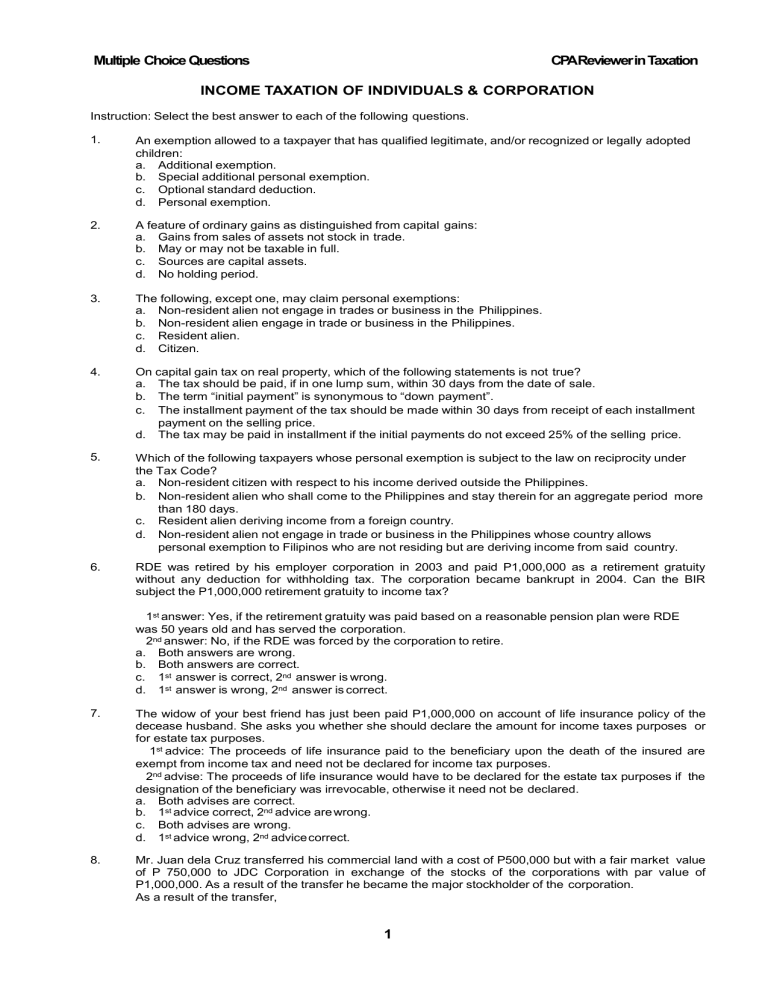

Income Taxation Of Individuals Corporation

Income Tax Testbankanssss Pdf Tax Deduction Taxpayer

Taxation Principles Dividend Interest Rental Royalty And Other So

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)